FSSAI Registration Certificate

- Free Experts Assistance

- Minimum Price guaranteed

- Quick and Hassle-Free Process

- Free Consultation on Import-Export Compliance

- 20 years experience & Serving more than 1100+ companies

- Providing one stop solution for all Annual compliances

CONTACT US

Our advisor is just a call away

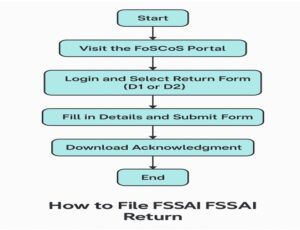

Here is an easy-to-follow visual representation that outlines the steps involved in filing your FSSAI annual return through the FoSCoS platform:

1. Access the FoSCoS portal by visiting https://foscos.fssai.gov.in/.

2. Log in using your credentials and proceed to the section titled “Annual Return.”

3. Choose the relevant form – either Form D1 (for general manufacturers) or Form D2 (specifically for dairy-related operations).

4. Enter all necessary details, including categories of products, quantities handled, and other required information.

5. Submit the completed form and download the confirmation receipt for your records.

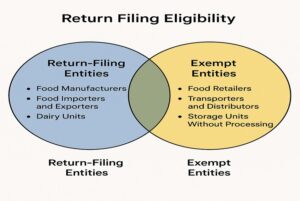

The following diagram helps clarify which food businesses are required to submit returns under FSSAI regulations and which are exempt:

– Entities Required to File: Businesses involved in manufacturing, exporting/importing food, and dairy operations.

– Exempted Entities: Businesses that retail food, handle food transportation, or operate storage facilities without processing are generally not required to file.

– Overlap Area: In cases where businesses have mixed activities, such as partial processing, specific clarification may be necessary.

Detailed FSSAI Annual Return Filing Guide

Understanding FSSAI and Its Significance

The Food Safety and Standards Authority of India (FSSAI) is a self-governing organization operating under the Ministry of Health & Family Welfare. It is tasked with overseeing and regulating food safety standards across India.

Why FSSAI is Essential:

– Guarantees the safety and quality of consumable products.

– Helps build customer trust and strengthens the credibility of food businesses.

– Implements consistent food safety rules throughout the country.

– Plays a key role in curbing adulteration and promoting hygiene standards.

FSSAI Annual Return: What It Means

The FSSAI annual return is a compulsory compliance requirement for selected categories of food businesses. It captures information about food items that the business has manufactured, imported, exported, or otherwise dealt with over the past financial year. This report must be filed with the FSSAI annually.

Who is Obligated to Submit the FSSAI Annual Return?

The following types of businesses must comply with this annual filing requirement:

– Companies involved in food production or processing, including repackaging and relabeling activities.

– Businesses importing or exporting food products.

– Units that handle dairy, meat, or similar food products.

Businesses That Are Not Required to File the Return

Some food business operators are not mandated to submit annual returns. These include:

– Retail outlets selling food products.

– Transport and distribution companies, unless otherwise specified.

– Warehouses and storage units that do not carry out any form of food processing.

Types of FSSAI Returns Based on Business Activity and Product Type

The nature of your business and the types of food you handle determine which form you must use:

– Form D1: Applicable to most manufacturers and importers, including those handling oils and dairy.

– Form D2: Required specifically for businesses that manufacture or process milk and related products. This return is filed every six months.

Information Required in FSSAI Annual Returns

When submitting the return, you’ll need to provide the following details:

– Business name and registered address.

– The FSSAI license number issued to your business.

– List of food products dealt with.

– Quantities manufactured, imported, or exported.

– Details of where and how products were sourced.

– Sales and distribution data.

Filing Deadlines for FSSAI Returns

– Form D1 (Annual Return): Must be submitted by May 31st following the conclusion of the financial year.

– Form D2 (Half-Yearly Return for Dairy Operations):

– The return for April to September must be filed by October 31st.

– The return for October to March is due by April 30th.

Consequences for Missing FSSAI Return Deadlines

– A late fee of ₹100 per day is charged for each day of delay.

– Not filing the return can lead to suspension or cancellation of your FSSAI license.

– You cannot voluntarily surrender your FSSAI license until all pending returns are duly submitted.

Explained in Detail: FSSAI Forms D1 and D2

Understanding Form D1: General Annual Return

Form D1 is a universal return document required for all licensed entities engaged in food manufacturing, importing, or processing. This includes businesses involved in repackaging and relabeling. The form gathers extensive data on food items managed over the financial year, helping verify that business practices comply with FSSAI safety regulations.

Key Information to Include in Form D1:

– Names and quantities of all food items manufactured or imported.

– Export details, including destination countries.

– Where raw materials were sourced from.

– How and where food products were stored and distributed.

– Batch details and product shelf life records.

Example:

Let’s consider a company called ‘Healthy Treats Pvt. Ltd.’ which produces and repacks organic snacks and flavored dried fruits. Throughout the year, they manufacture 25,000 bars and import 10,000 kg of dried fruits from Australia. In their D1 form, they need to report product types and quantities, the countries they import from, export destinations (like the UAE and Singapore), and their distribution routes.

Understanding Form D2: Half-Yearly Dairy-Specific Return

Form D2 is intended solely for food businesses that operate in the dairy sector. These businesses must file this return twice a year, documenting their milk-related activities.

Details Required in Form D2:

– Total amount of milk received or processed.

– Source of milk (individual farmers, cooperatives, etc.).

– Categories and volumes of milk products made (e.g., paneer, ghee, butter).

– Cold storage arrangements used.

– Information on how and where dairy products are distributed and sold.

Example:

Take ‘Fresh Moo Dairy’, a business in Maharashtra that handles over 1 lakh liters of milk monthly to make products like yogurt, ghee, and paneer. For the April to September reporting period, they receive 5 lakh liters of milk from local farms and produce 2 lakh units of dairy goods. These figures must be included in Form D2 and submitted by October 31st. The next return, covering October to March, is due by April 30th.

Final Thoughts

Accurately completing and submitting Form D1 or D2 not only helps food businesses remain compliant with FSSAI guidelines but also contributes to public health and transparency. These filings support food traceability and accountability across the entire supply chain, reinforcing consumer safety and trust.

Frequently Asked Questions (FAQs)

Q1. What if I miss the FSSAI return deadline?

A: A fine of ₹100 is imposed for every day the return is delayed.

Q2. Can I give up my FSSAI license without completing the return filing?

A: No, all returns must be completed before surrendering the license.

Q3. Do I need to file separate returns for each FSSAI license?

A: Yes, each individual license mandates its own return filing.